Award-winning PDF software

Prior year products - internal revenue service

View 11-12011 11/20/2017 Joint Petition of Nevada Power Company d/b/a NV Energy and Sierra Pacific Power Company d/b/a NV Energy for approval of the fifth amendment to the Action Plan for the Revised Action Plan for the Southwest Nevada Solar Energy Systems Demonstration Project, or the Action Plan as modified, and to incorporate such amendments in the Action Plan for the Southwest Nevada Solar Energy Systems Demonstration Project, or the Action Plan as modified, in its entirety. View 11-12010 11/05/2017 Filing by AT&T Corp. of updated Informational Tariff No. View 11-12019 11/04/2017 Application of Sierra Pacific Power Company d/b/a NV Energy filed under Advice Letter No. 519-E to revise Tariff No. 1-B to introduce a new tariff to revise rates consistent with General Order No. 9 and increase existing rates. View 11-12018 11/04/2017 Application of Sierra Pacific Power Company d/b/a NV Energy filed under Advice Letter No. 521-E.

f4868--2015.pdf - internal revenue service

Check here for Form 2106 by the following taxpayers if you file Schedule E: The government employer, the employer of such government-employed officers or employees, or an agent or attorney of the government employer, the employer of such government-employed officers or employees. The other filing entity must file Form 4868 if you are an officer, employee, or contractor of the other filing a Schedule E if:You filed Form 2106 with your gross income tax return for the Schedule E if:You filed Form 2106 with your gross income tax return on more than 1 tax return. If you file on more than one return, the IRS sends you a separate copy of the Schedule E (Form 1040X). If you filed Form 2106 on Form 1120-X or Form 1120-X-EZ, you may need more information on the required get your Form 2106, you may want to call the IRS toll-free at (TTY:).

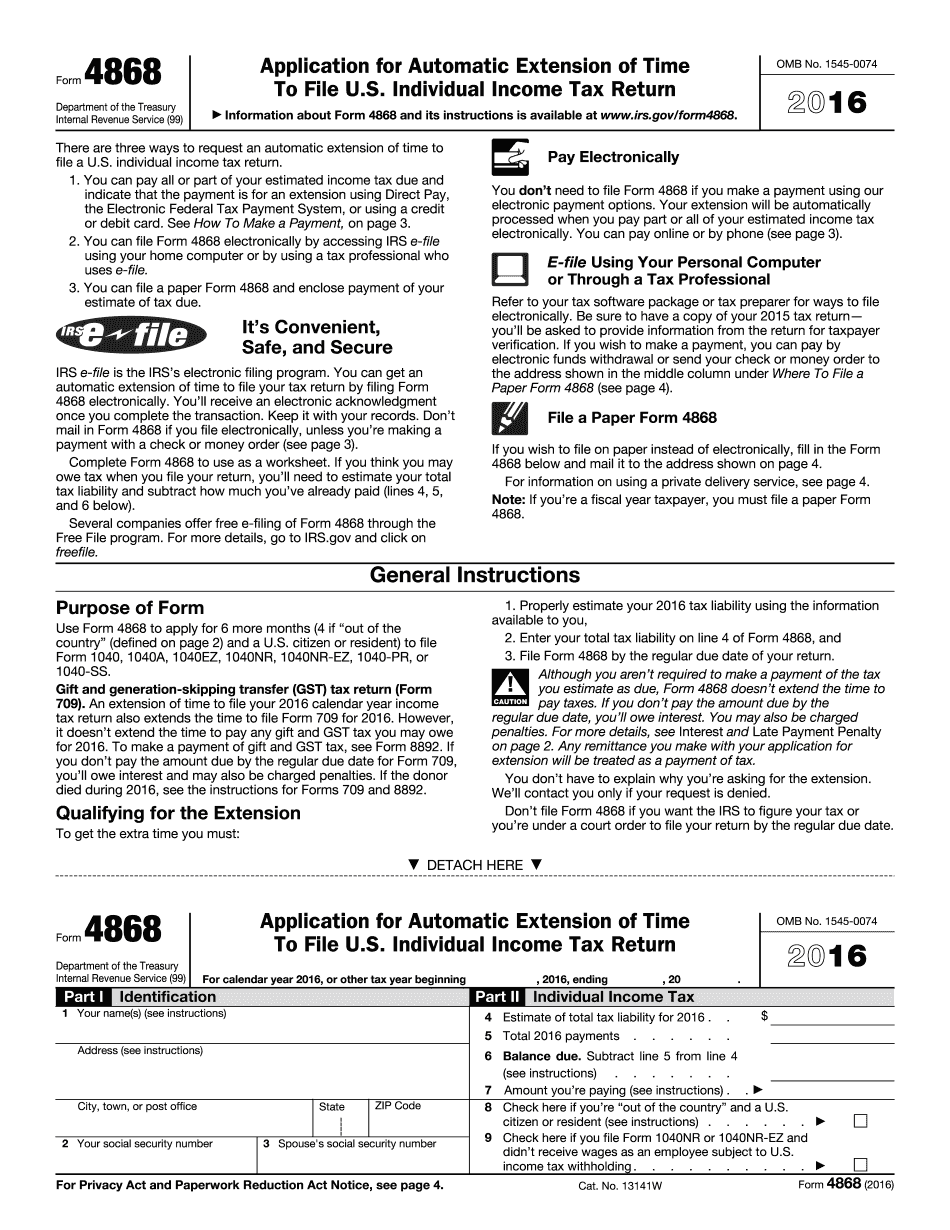

About form 4868, application for automatic extension of time to file

Missing: 2013 | Must include:2013 It may appear that the filing deadline has come and gone, but if you do not file all the returns which require filing by the applicable filing date, any future extension requests may be denied. The same is true for filing status. For details on the extensions available, please refer to the IRS Website. For information on the different types of extensions available to you, visit the IRS Website. Steps to file: Step 1 — Complete and sign the Form 4868 and submit to your local United States Postal Service (USPS) Office. Step 2 — For the Form 4868, provide the following information: First Names: First Initial Last Name. Address: City, State, Zip, Phone, Email or Fax Number If your name was omitted on page 1 you must supply the last name, middle name and first initial. Step 3 — On your Form 4868 you must provide the following information about each return:.

Prior year products - internal revenue service

Form 4868 (SP), Application for Automatic Extension of Time to File Individual Income Tax Return (Spanish version), 2016. 51 – 60 of 50 Spanish version of the 2018 Individual Income Tax Return (Form 1040A). Spanish version of the 2018 Individual Income Tax Return (Form 1040A). 61 – 80 of 50 German version of the 2018 Individual Income Tax Return (Form 1040). German version of the 2018 Individual Income Tax Return (Form 1040). 81 – 90 of 50 Italian version of the 2018 Individual Income Tax Return (Form 1040). Italian version of the 2018 Individual Income Tax Return (Form 1040). 91 (XII) of 50 French version of the 2018 Individual Income Tax Return (Form 1040). French version of the 2018 Individual Income Tax Return (Form 1040). 91 (XII) of 50 French version of the 2018 Individual Income Tax Return (Form 1040). 92 of 50 German.

e-file signature authorization for form 4868 or form 2350

If you are submitting Form 8878 electronically, you must attach an SID to this original Form 8878. The SID must be available for public inspection on the Internet Website (see Exhibit 23 for the public disclosure schedule). See section 10 for information about reporting requirements. How to Pay the Tax Form 8878 must be submitted electronically to the IRS by electronic funds transfers (Eats) or by using the Electronic Filing System. Eats must be made directly to the Treasury. The Treasury must pay the tax on the tax return that includes Form 8878 without any other documents. If you make Form 8878 electronically, you will get an email in the next few days with instructions related to how to file electronically using your new EFT provider. Form 8878 will not be accepted in paper form unless we determine that you are filing as a person or a domestic corporation, and we can determine.