Award-winning PDF software

Form 4868: Application For Extension Definition - Investopedia: What You Should Know

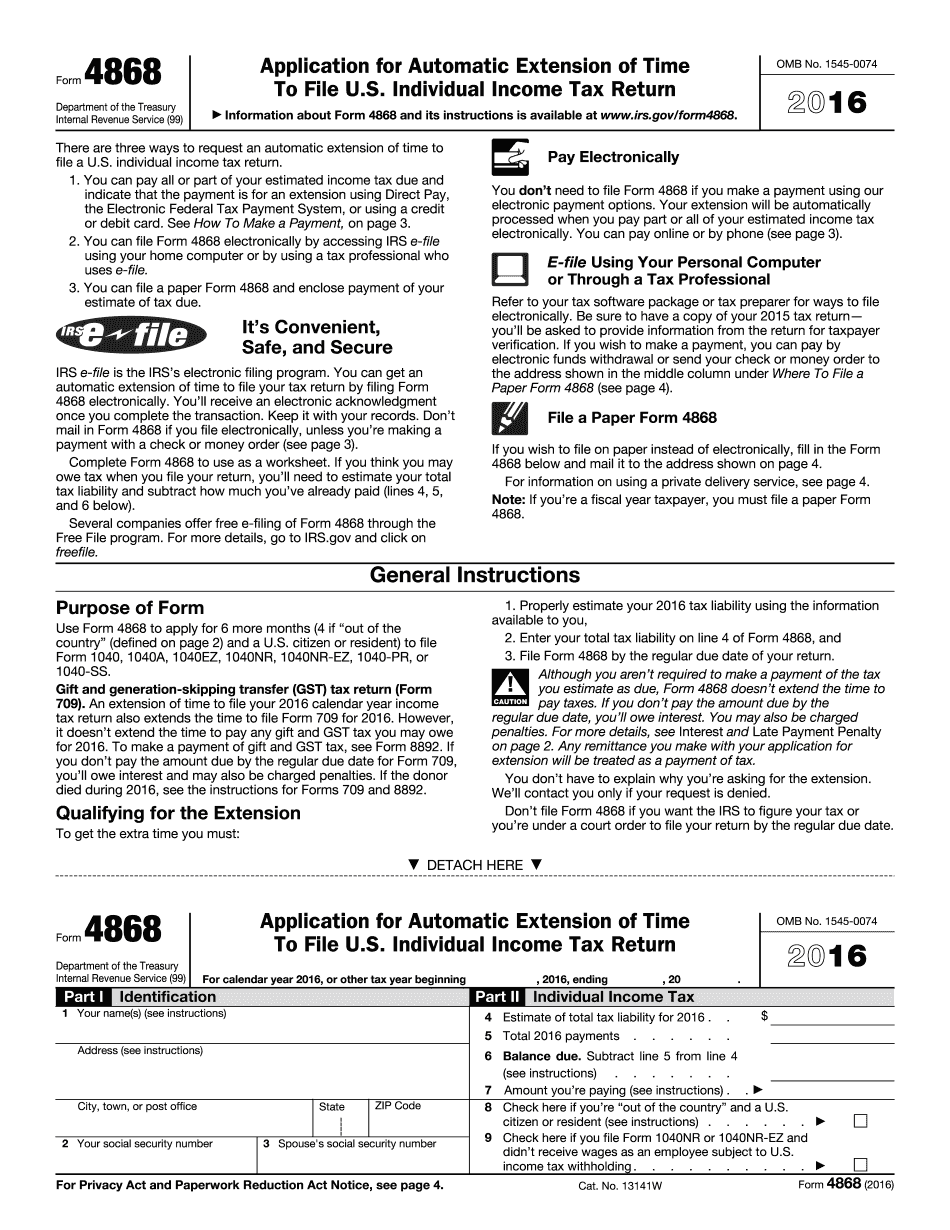

Form 4868 is available to the public and can be filed at any time after 5 p.m. ET of the following business day. If you receive Form 4868, you can file up to 9 returns with it, all on one day each time. Form 4868 can be downloaded by filling out and submitting Form 4868 at any IRS public or private site. The IRS also recommends using Form 4868 only if one of the following circumstances applies: It is a very unusual circumstance That the taxpayer's return was inadvertently mailed at the wrong time Form 4868 does not have the taxpayer's social security number or taxpayer identification number, and no other information with which an IRS officer could positively identify the taxpayer Form 4868 is not requested under any other provision of the Internal Revenue Code. Who is Eligible to File Form 4868 Individuals who meet certain eligibility requirements are eligible to file Form 4868. Individuals need to have a Social Security Number (SSN) to file a return with the IRS and are allowed to delay filing (Form 4868). In addition, taxpayers with limited-English proficiency are also allowed to request an extension to file. Who Qualifies for an IRS Form 4868 Request? Individuals are eligible to request an IRS Form 4868 for two major reasons. Under IRS Guidance, individuals can only request an automatic extension of time to file if the following applies: (1) Their return is due before April 15; (2) The taxpayer lives outside the United States; and (3) Either the taxpayer did not anticipate the need for an extension, or did not act responsibly for not anticipating the extension. Individuals who qualify for an extension of time to file based on one of these criteria are eligible to request Form 4868 and can file up to 9 returns with Form 4868 each year. Individuals who qualify for an extension under another definition may complete a Form 4868 to extend the expiration date. However, if the individual was not aware that the extensions were available before the extensions become available, the individual can only request extensions for a total of 6 months (4 if out of the country and 3 if abroad on business). For a complete list of the most common Form 4868 questions and answers, see IRS Form 4868 — Frequently Asked Questions.

Online options allow you to to prepare your doc administration and raise the productiveness within your workflow. Comply with the short help with the intention to total Form 4868: Application for Extension Definition - Investopedia, prevent mistakes and furnish it inside of a well timed manner:

How to complete a Form 4868: Application for Extension Definition - Investopedia on-line:

- On the website aided by the type, click Start out Now and pass into the editor.

- Use the clues to complete the suitable fields.

- Include your own material and make contact with details.

- Make absolutely sure that you enter accurate material and quantities in best suited fields.

- Carefully take a look at the material in the type in the process as grammar and spelling.

- Refer to support segment if you have any thoughts or handle our Support group.

- Put an electronic signature on your own Form 4868: Application for Extension Definition - Investopedia aided by the enable of Indicator Device.

- Once the shape is completed, push Completed.

- Distribute the all set form by means of electronic mail or fax, print it out or conserve on your unit.

PDF editor will allow you to definitely make adjustments towards your Form 4868: Application for Extension Definition - Investopedia from any internet related unit, personalize it as reported by your needs, indicator it electronically and distribute in several techniques.