Award-winning PDF software

About Form 4868, Application For Automatic Extension Of Time To File: What You Should Know

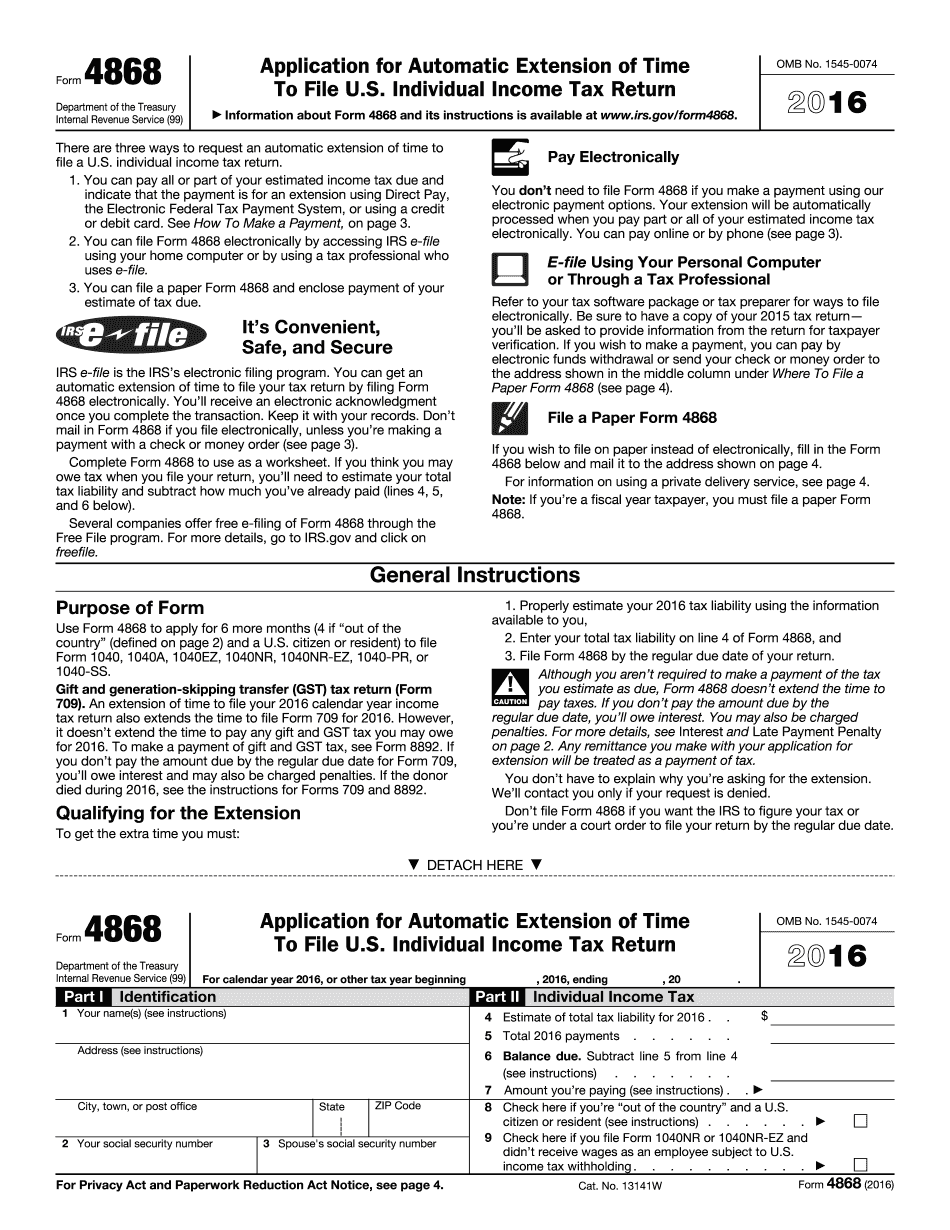

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return Form 4868 is used to request an extension to file IRS income tax returns, generally starting in the tax year that tax is paid. The extension can be for a number of reasons: · Taxpayer elects an automatic extension of time as outlined in IR-4685, Notice of Automatic Tax Extension. In this case, the extension will be applied to future returns filed after the extension request is processed. This may occur if the taxpayer's tax liability for a previous year is less than 10 percent. · Taxpayer requests a postponement of the filing deadline from April 18, 2022, to October 15, 2022. This extension will be applied to future returns filed after the postponement request is processed only when tax liability for the current tax year is over 10 percent. IRS form 4868 gives taxpayers more time to pay their tax bill and avoid late taxes. If this extension applies to you, you are automatically entitled to make your annual tax payments no later than October 15, 2022. (This is the same as filing the extension at that time.) IRS Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return Form 4868 is a U.S. Individual Income Tax Extension Request Form that allows you to request an extension to file your federal tax return beginning April 18, 2022, through October 15, 2022. You simply fill out the form and attach it to your tax return. Example You are a U.S. citizen residing in Canada and want to file a Canadian tax return. You filed your original return on April 15, 2022, and are now a resident of Canada. You want to request an automatic extension of time to file your Canadian income tax return on January 31, 2023, because the deadline for filing Canadian income tax returns for the previous tax year is October 15, 2022. What to do If you are required to file a tax return after April 18, 2025 (or October 15, 2022), you have five years from April 18, 2022, to file that tax return. The date the tax return may be filed depends on many things, including, for example, whether your tax return must be filed electronically. Check with your local tax authority to find out whether the tax return should be filed electronically or not.

Online answers assist you to to prepare your doc administration and supercharge the productiveness within your workflow. Abide by the short guideline as a way to finish About Form 4868, Application for Automatic Extension of Time to File, stay away from mistakes and furnish it inside of a well timed manner:

How to accomplish a About Form 4868, Application for Automatic Extension of Time to File online:

- On the web site with the sort, click on Start out Now and pass for the editor.

- Use the clues to fill out the relevant fields.

- Include your personal details and call details.

- Make positive that you choose to enter correct material and figures in appropriate fields.

- Carefully take a look at the material belonging to the type also as grammar and spelling.

- Refer that can help part in case you have any questions or handle our Help crew.

- Put an digital signature with your About Form 4868, Application for Automatic Extension of Time to File together with the aid of Signal Resource.

- Once the form is finished, press Performed.

- Distribute the completely ready kind by way of e-mail or fax, print it out or conserve on your own gadget.

PDF editor will allow you to make improvements for your About Form 4868, Application for Automatic Extension of Time to File from any online world related system, customise it as reported by your requirements, signal it electronically and distribute in several options.