Award-winning PDF software

Delay filing of income tax return Form: What You Should Know

S. CUSTOMS AND BORDER PROTECTION, DEPARTMENT OF HOMELAND SECURITY; DEPARTMENT OF THE TREASURY (CONTINUED) Part 191 – 17 CFR 181.2 — Drawback — Title 19 — Customs Duties Chapter 1 — Definitions and General Provisions 1. U.S. Customs and Border Protection (CBP) is an independent agency of the Department of Homeland Security (DHS). 2. Custom officers (CE's) are U.S. Customs officers responsible for enforcing U.S. laws and administering U.S. customs laws. 3. Custom officers must exercise discretion and good judgment when applying U.S. Customs laws to the conduct of any activities involving the import or export of goods into or out of the United States. Determinations by CCS must be based upon all facts and circumstances known to the CEC at the time of the decision. 4. Unless exempted as otherwise applicable, the requirements of this part with respect to U.S. Customs officers, CE's, and goods are in addition to and not in lieu of the requirements contained in the laws and statutes of the United States. 5. Subject to the specific authority and jurisdiction of U.S. Customs, CE's must protect the public while conducting U.S. Customs functions. 6. U.S. Customs officers have the responsibility to enforce U.S. customs laws and regulations. CE's are responsible for administering U.S. Customs laws. CE's have no discretion in determining the duties and restrictions imposed on goods entering or exiting the United States. 7. U.S. Customs officers may only initiate a final order in the event of a seizure or other violation of law, order, or regulations and must proceed at the least probable place and at the earliest time. 8. CE's conducting U.S. customs functions may use any available means which they deem appropriate for the efficient administration of these functions including, but not limited to, administrative subpoenas, administrative search warrants, court orders, administrative inspections, consent decrees, agreements with foreign governments, private sector agreements and agreements with U.S. firms engaged in international trade and business, and voluntary negotiations to achieve agreements. 9.

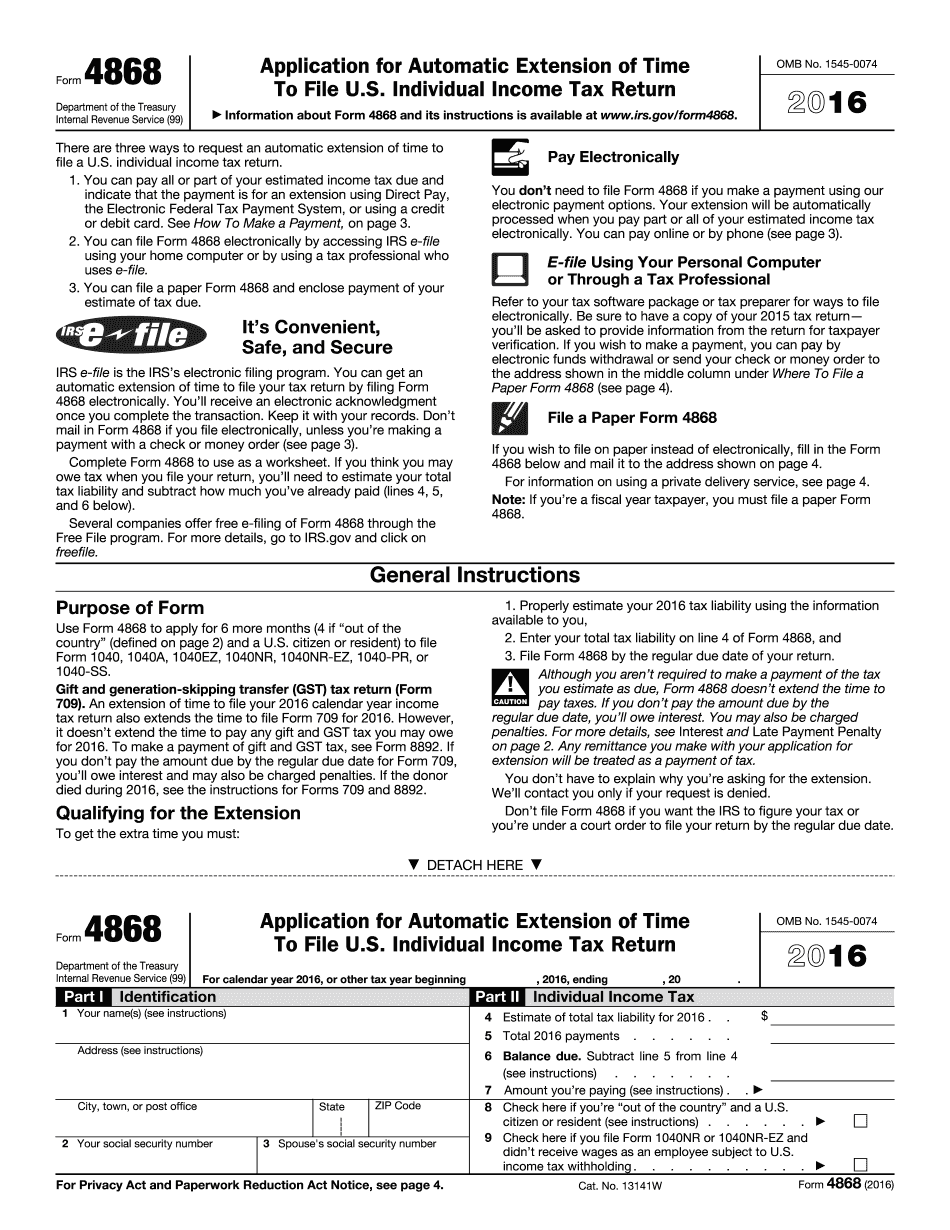

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 Irs 4868, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 Irs 4868 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 Irs 4868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 Irs 4868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.