Well what a wonderful thickened fog day to use survivor getting hit because of the vacuum palate changed thank God my name is Berkey welcome to dead by daylight case file featuring the clown or better known as the gassy boy Music see I would have liked to have called him the honky Boy but he doesn't have a honky nose behavior your shenanigans have gone too far all right the lure is pretty long so bear with me Kenneth chase was born in 1932 and because of labor issues it took his mother out of the world which caused a real rift between him and his father he grew up with unremarkable academics but excelled in athletic prowess tall strong but never willing to join team sports because he didn't really mesh well with other people eventually he found feathers on his walks home kept a collection of them in a cigar box under the bed which fixed hated him while his father spent his nights in a drunken stupor eventually he wanted to catch one so coaxing a local dentist he made a special anesthetic and rigged it to a bird feeder then he caught one a while he was fixated with it it woke up and attempted to run away out of his hands but feeling this rush of power Kenneth crushed the robbing of the bird in his hands he had planned to release it but the feeling of power was something he had never experienced in his life dispose of the body kept one feather tossing up the others as he considered them fake this led to him collecting even larger things larger prey squirrels cats dogs then soon a boy went missing at his school and when Kenneth's father found the boy's finger in...

Award-winning PDF software

Irs deadlines Form: What You Should Know

Form 707 (2023) must be filed by June 30 of the 10th month prior to the calendar year in which the return is due. Form 709 (2023) is due on December 31st for businesses employing at least 2 employees, but the due date may come late for many large businesses. When To File | Internal Revenue Service Sep 8, 2025 — Annual Notice for Taxpayers With a Negative Taxpayer Identification Number (NITA). This must be filed within 12 months of May 31 of the following year. When to File | IRS Aug 23, 2025 — Tax Withholding and Withholding Returns Due: This form is for nonfilers. All taxes (including those due from the following year) must be paid by December 31st. Businesses with no employees for tax year 2019: If you have employees, you file and send this Form 709 by April 15 of the year following the year you'll be filing the return. May 15, 2025 — For any businesses with no employees by April 15 or after, This form must be filed by August 10. This form must be filed with a payment. To file this form, send a check or money order for 15 with your 1040 (or W8-fillable). For example, if your tax year is 2019, send your check or money order for 15 for 1040 (or W8-fillable) to our office. If you're not filing by July 15th, you'll have to pay taxes at the same time you file your tax return. Note (July 15, 2019, through Jan 31, 2020) : This form must be filed by May 15, 2020. Feb 17, 2025 — Notice of Return or Return and Payment of Taxes. It can be filed electronically, or by mail if return is postmarked within 30 days. Jun 30, 2025 — Tax Refunds for Any Businesses. If a company that does not need to pay any taxes has a negative tax return, this form must be filed prior to the due date of the last return and payment. Aug 3, 2025 — Business Income Taxes. This form can be used for annual return. This is not to be filed with returns sent by the 15th of January or earlier.

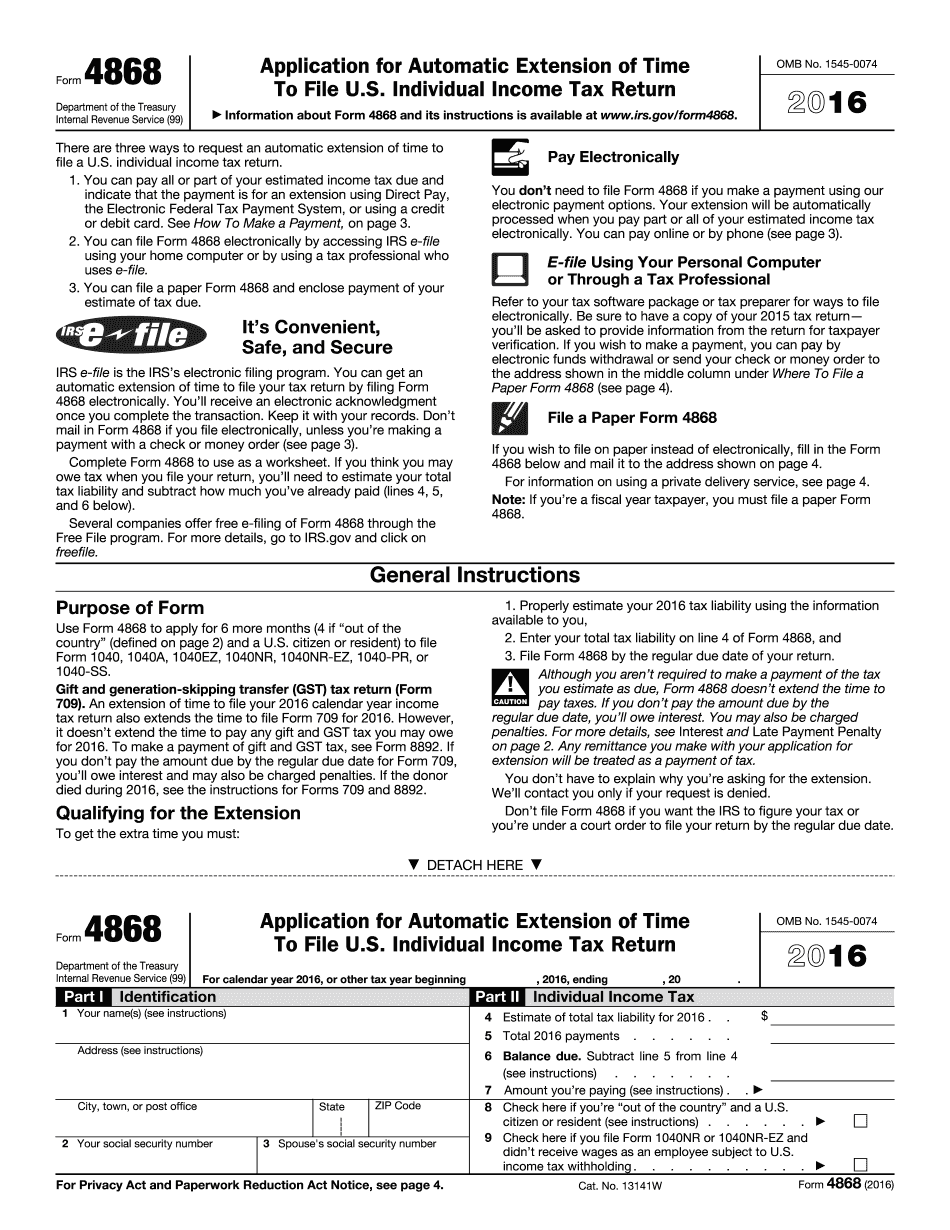

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 Irs 4868, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 Irs 4868 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 Irs 4868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 Irs 4868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs deadlines