Where you won't make that tax deadline, need some more time to file? After, CALM can help you with that. - With File After, you can e-file a tax extension with the IRS in less than 10 minutes. - File After is an authorized IRS e-file provider. - File After has an easy-to-use system full of helpful pop-ups and guides that will get your extension filed and approved quickly. - So, don't worry about deadlines and confusing tax jargon. - Visit File After and e-file your tax extension now.

Award-winning PDF software

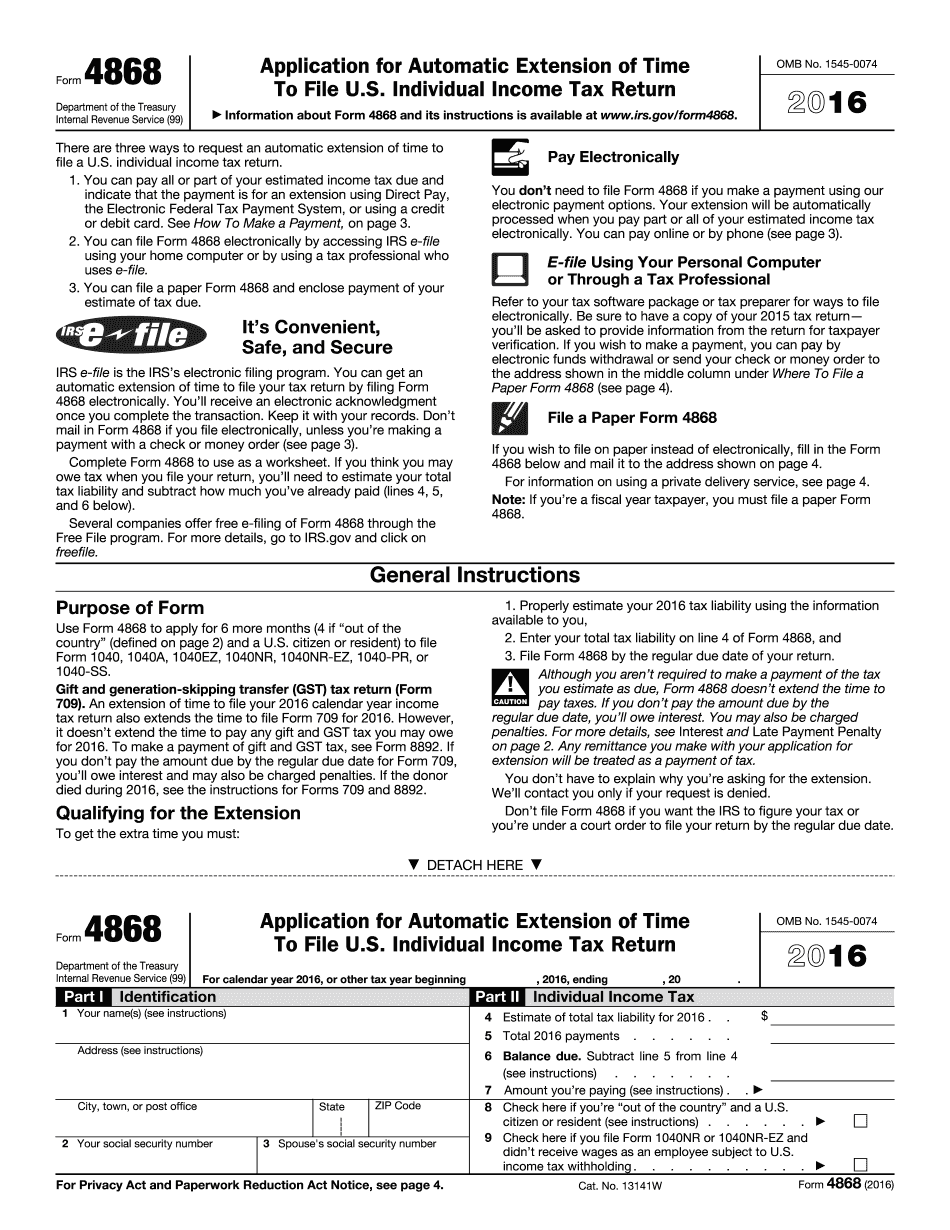

4868 filing address Form: What You Should Know

IRS forms change each year? (IRS forms with new instructions) How do I update my tax extension information if my address has changed? Jan 15, 2025 — The extension information you supplied to us when you filed your tax return has been updated. If you would like an updated extension information, we require proof of address change in the form of a change of address notice. If you do not respond to the change of address notice within 20 days, our system will assume that you have not filed your extension, and you are no longer eligible for the extension. You must contact us to request this information. You can also update your extension electronically through IRS e-Files. Furthermore, you must get an extension. Furthermore, you can file one form and pay with a payment plan for up to 6 years. If you receive an extension you can still request that the IRS extend your deadline when filing Form 4868, Form 4868-R, Form 4868-T, Form 4868-V, or Form 4868-W, or to change your income to include earned income tax credit. Note: If you've already filed your extension information online with IRS e-File using TurboT ax, you don't need to do anything more to file Form 4868, Form 4868-R, Form 4868-T, or Form 4868-V. You must file your extension form electronically using the extension computer software that you purchased. What else can I do when I find something wrong with my income? If you're not satisfied with the answers you've received from us, you can file a complaint with the IRS. To do that, fill out Form 3929, Complaint to Inspectors General from the Income tax Processing Center. The complaint page has instructions and procedures for how to file and how you should respond, and what you can do if you disagree with the way we are handling a particular situation. Follow these steps in the complaint process: Contact your local Taxpayer Advocate. Request a copy of an IRS Form 3929 by calling the IRS toll-free helpline at (from anywhere in the United States). The helpline number changes daily. The helpline opens approximately 24 hours a day; depending on what time of the day you call, your call might be answered as early as 5 to 5:30 a.m. or as late at 9:30 p.m.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 Irs 4868, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 Irs 4868 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 Irs 4868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 Irs 4868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 4868 filing address