An IRS tax extension can be filed by any individual needing additional time to file their tax return for the year. To extend your filing deadline for six months, you can e-file the IRS form 4868 when visiting expressextension.com. The entire process takes just a few minutes and all you will need is your social security number, your estimated tax amount, and the amount you are paying now. From expressextension.com, you can create a free account or sign up with Facebook. Once inside, you can select which type of extension you need to file. You can choose if you're filing individually or jointly, and indicate whether or not you owe taxes. If you do owe taxes, you will need to enter your tax liability, the total payments you've made for the year, and the amount that you'll be paying the IRS at this time. Keep in mind that a tax extension is an extension of time to file, not necessarily time to pay. On the next page, you can select if you're paying by Electronic Funds withdrawal, or you can choose to pay by check or money order. You can review your information, and if everything is correct, you can click the "Review" button to proceed. Express Extension will then conduct a basic audit of your information, and if no errors are found, you can continue. You can select if you would like to file just this form, and you may add additional email addresses. Express Extension also offers text alerts and fax alerts to let you know the moment your return is accepted by the IRS. On the order summary page, you can review everything one last time, including your billing information. When you're satisfied, you can click "Pay and Transmit" to e-file the form with the IRS. After...

Award-winning PDF software

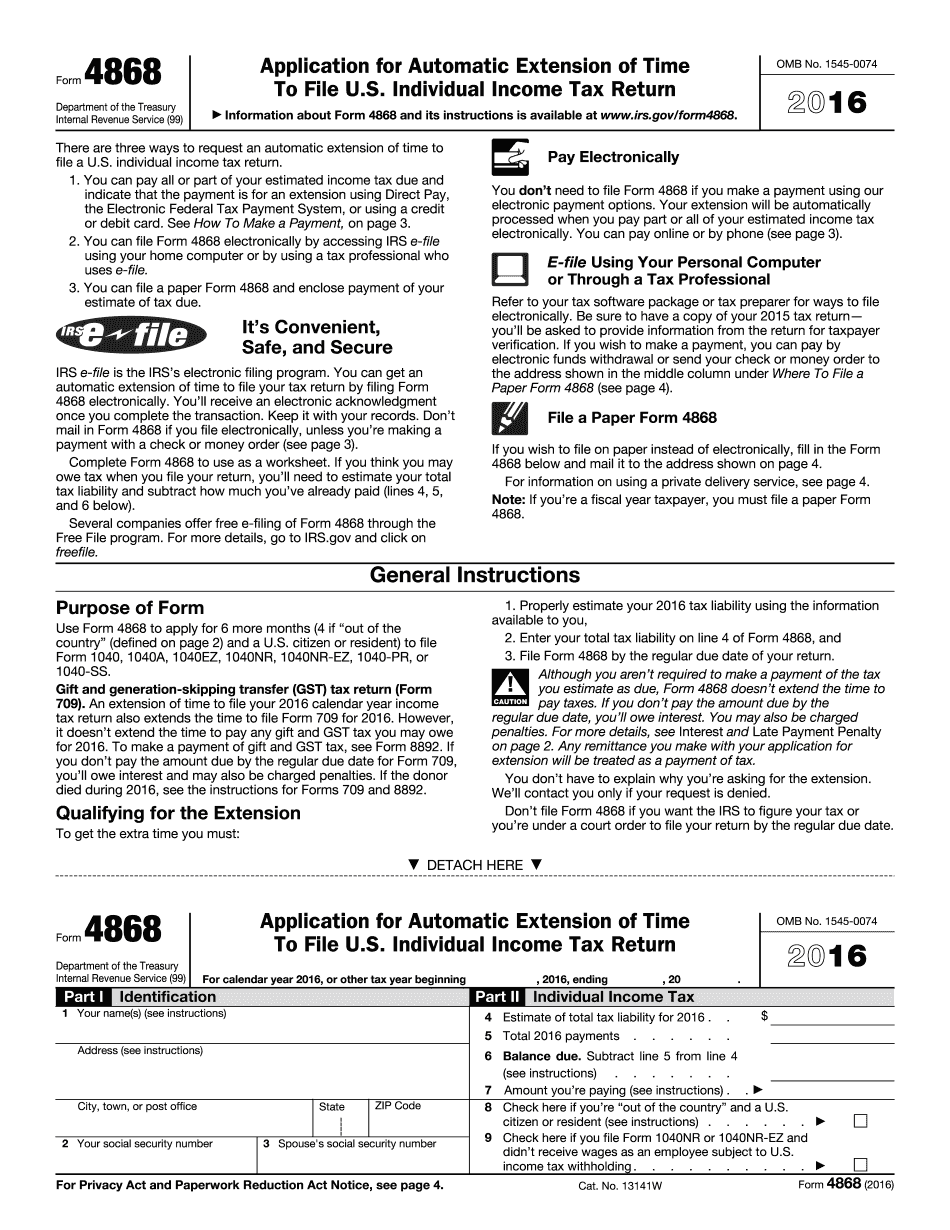

4868 electronically Form: What You Should Know

For more information about receiving your extension please see How to Request a Tax Extension. Georgia's residents can e-file your extension with the . The IRS does not accept returns filed after April 18, 2022, if filed in person. Georgia's residents can e-file their tax extension online through the . However, if the return was filed by mail, the deadline for requesting an extension is 30 days from the date of filing the returned check. You Must File by the Due Date on the Return: If you did not receive a check from the IRS in a timely manner, you must file your return by the due date (due date is the 3rd business day after the date by the date the return was received by the IRS) unless you filed a return for a month in the tax year. If you file your return for the month in which the return was received by the IRS, you are not required to file on time, but you must fill out the return and return it using the due date instructions. What If I am Losing My Job? What about a Pregnancy? If you are unemployed, and you do not receive unemployment benefits, or you have applied to and been rejected for benefits, you are not required to file a FTA form. If you are pregnant and not receiving pregnancy benefits, you are not required to file a FUTURE form. You are no longer subject to an income test of 60% of your earnings that may apply to you. However, you have to file a separate report. See What is Covered by a Medical and Physical Exemption There is no longer an individual exemption. What if you have a disability? If you are considered mentally or physically incapable of working (not necessarily disabled) you may apply for the special income tax exemption called “Section 502(b) Employment Exemption”. If you are considered disabled, but not completely disabled, you may be entitled to an additional exemption (sometimes called the “childless exemption”). The “childless exemption” requires the filing of a tax return each year. You must also have an Individual Tax Identification Number (ITIN) by the due date for paying taxes when calculating the benefit you are entitled to for the individual exemption. For more details please see: What about other tax exemptions and exclusions? You are subject to the alternative minimum tax.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 Irs 4868, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 Irs 4868 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 Irs 4868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 Irs 4868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4868 electronically