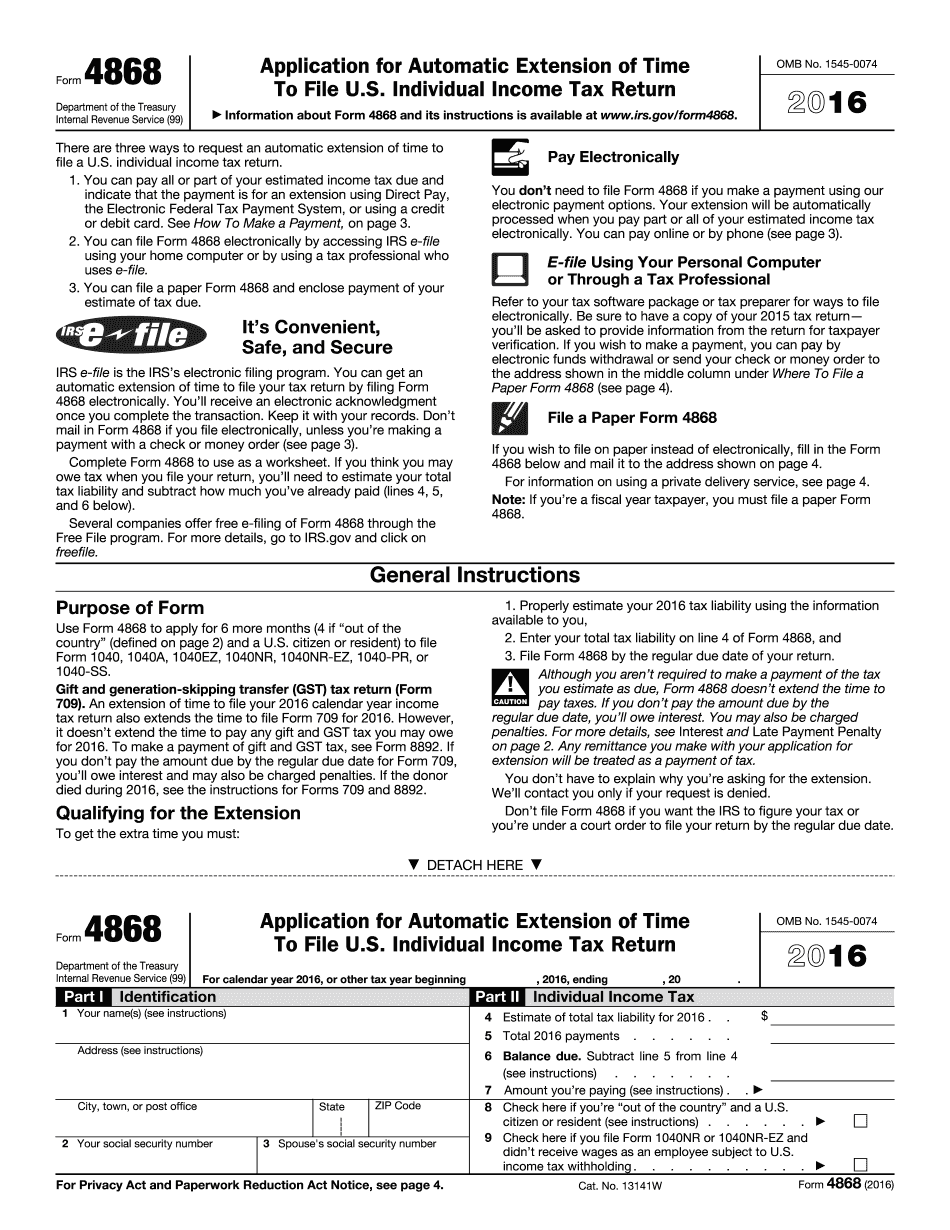

Hi everyone, this is a video where I will show you how to file form 4868, which is an application for an automatic extension for U.S. individuals. Now, there are two things to consider here. If you are a professional or not, if you have a company, such as a single member LLC, independent contractor, or even just an individual with W2 income, you need to make sure you file your extension form. I talked about this earlier in the video, explaining the reasons why you should file and some important considerations when filling out your extension. Please note that the extension is due on April 18th, and you only have a few days left, as it has to be postmarked by April 18th. Another important thing to know is that you can also pay by credit or debit card, either over the phone or through the internet with the IRS if you owe money. That's why filing the extension is crucial. Even if you don't owe any money, you should still file your extension, regardless of whether you have the money to pay or if you're expecting a refund. You want to make sure your return is not filed late. Filing a paper extension is not difficult, as it's a simple process. Plus, you get an automatic six-month extension to file, so your return will be due on October 17th. However, I advise against procrastinating. Before proceeding, the key thing you need to determine is whether or not you owe money. To do that, you have to roughly estimate your total tax liability, which can be done in part two of form 4868. I have a spreadsheet that can help you with this calculation. Let's say you're a single member LLC or an independent contractor with money coming in. The first thing...

Award-winning PDF software

2016 Irs 4868 Form: What You Should Know

Form 1040, 1040NR, or 1040NR-EZ, whichever is first. Form 4868 (SP)--2016.pdf — IRS To File U.S. Individual Income Tax Return—Individuals, Partners, Unincorporated Unions, and Estate and Gift Tax Entities. If you file a Form 4868, you should get ready to use it by April 18, 2025 (see “Additional resources” below). If you are filing a for a partnership, corporation, or trust. About Form 4868 (SP), Application for Automatic Extension of Time to File U.S. Information from Extension Form — Tax Year Ending December 31, 2025 (Whole Dollars), 2025 ; Form 4868 (SP) Additional resources: IRS e-file Extension Form 2350 Form 2350 is used by individuals who do not file an extension for U.S. individual income tax returns for tax years (including extensions) ending December 31, 2019, 2020, 2023, or 2026, but who have filed an extension for an extension of time to file for that tax year. Form 2350 (SP), Application for Automatic Extension of Time To File U.S. Individual Income Tax Return (Spanish version) -- IRS Results 1 – 50 of 51 — Form 2350 (SP)-2016.pdf -- IRS About Form 2350 (SP), Application for Automatic Extension of Time to File U.S. Information from Extension Form -- Form 1310 -- Fiscal Year Ending December 31, 2025 (Whole Dollars), 2016 Results of Form 2350 (SP) (Spanish version) Form 1310--2016.pdf Form 1310 (SP)--2016.pdf — IRS Additional resources: Additional Resources: Form 2350 (SP)-2016.pdf — IRS The form you may use for Form 4868 is Form 2444 with instructions and Form 2444 (spa ctr. Of November. De Then), Application for Extension of Time To File U.S. Individual Income Tax Return (Spanish version) -- IRS If you will file a Form 2350, you must include the Form 4868, Application for Automatic Extension of Time To File U.S. Individual (SP)--2016.pdf -- IRS with copies of your documents. Form 4868, Application for Automatic Extension of Time To File U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 Irs 4868, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 Irs 4868 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 Irs 4868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 Irs 4868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Irs 4868